Android Pay

I’ve been keenly following the development of Android Pay for some time now. I was really quite excited, partly because I was looking forward to impressing my friends (and the odd barista) by simply bringing my phone closer to the POS terminal and then walking away from a crowd looking at me in amazement.

What is it?

Android Pay is a new payment philosophy, which leverages your phone’s NFC (near field communication) and HCE (host card emulation) capabilities to emulate your credit/debit cards as well as any gift and loyalty cards.

To find out whether your phone supports Android Pay, simply install the Android Pay app from the Google Play Store and it will tell you.

How to use it?

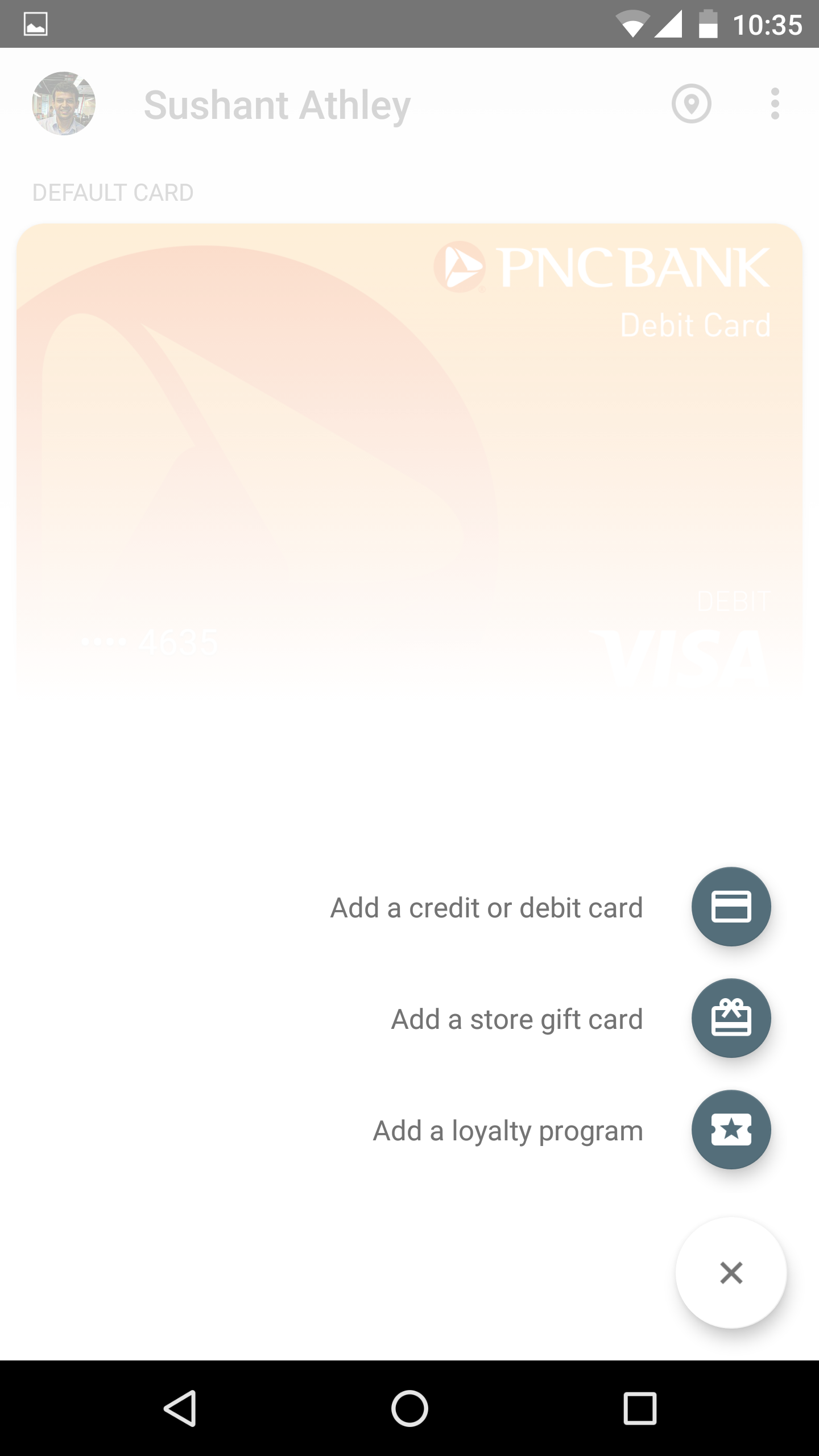

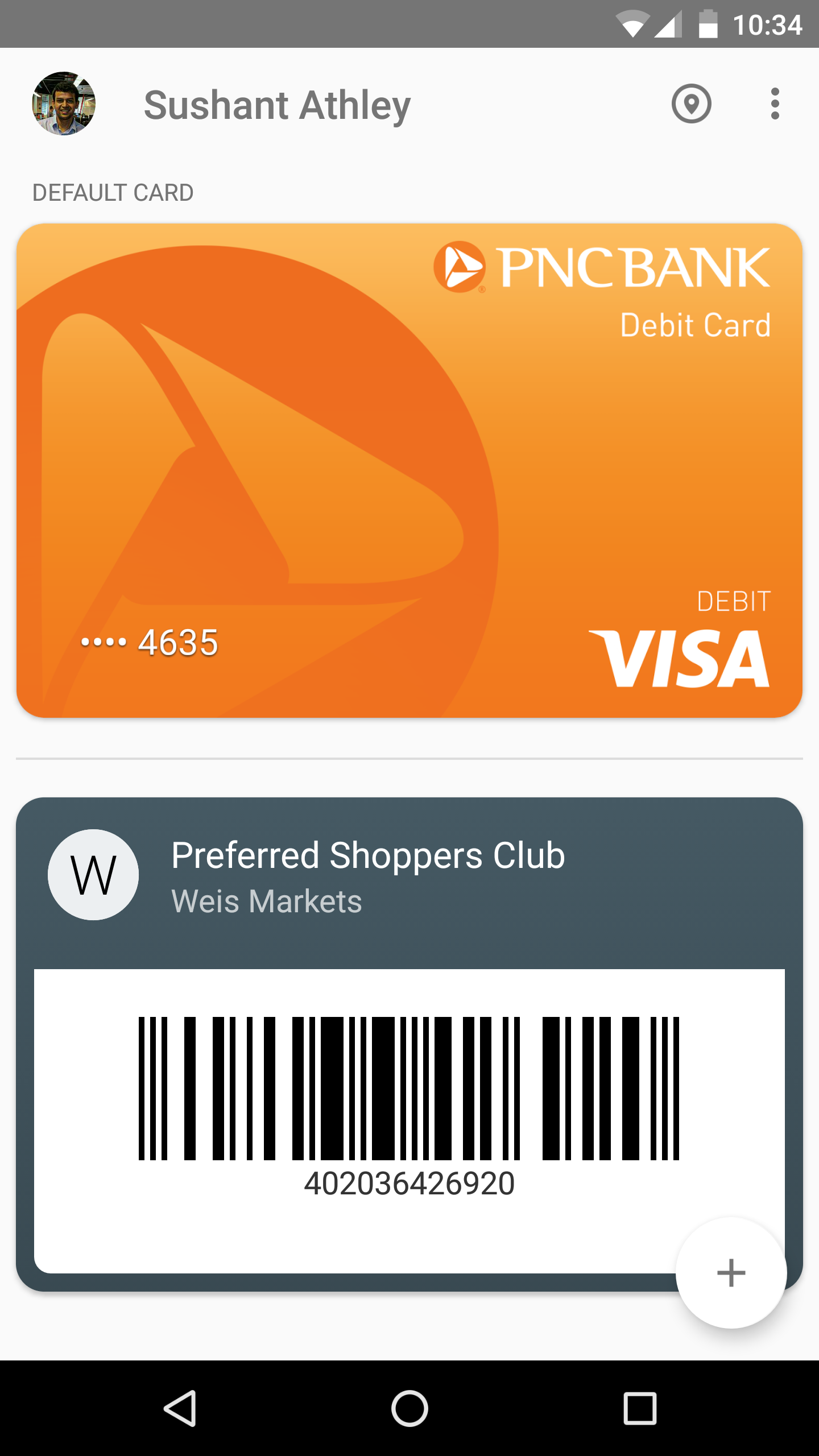

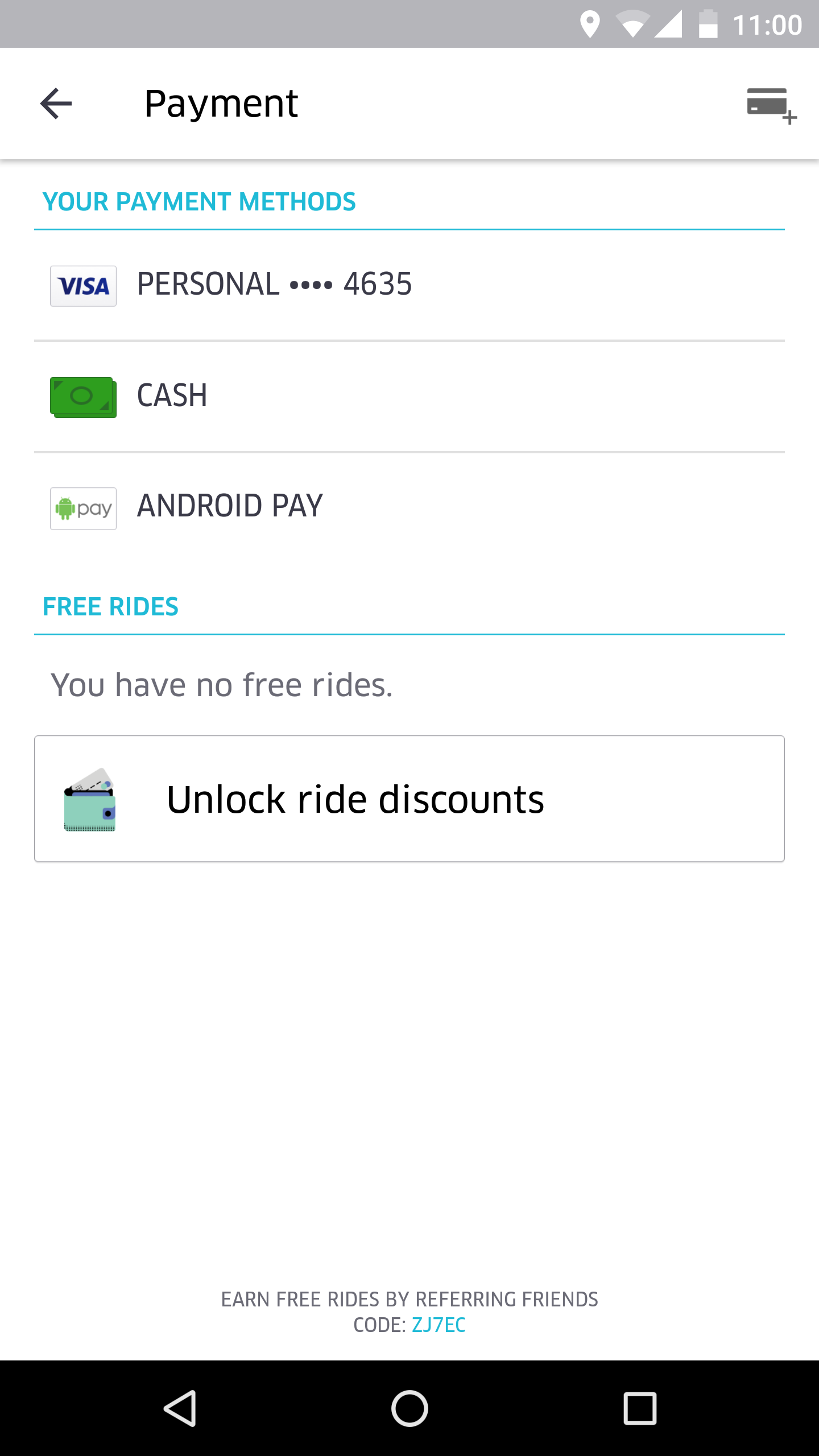

The first step you need to do is to install the app and add your card details into the app. You will notice that not only can you add credit/debit cards, you can also add gift cards and loyalty cards from various retailers in the country.

Once you’ve added your card details, you are ready to go. The next time you order your grande hazelnut latte at your favourite coffeeshop, simply unlock the screen and tap your phone on the card payment terminal. Look for the Android Pay sticker in the vicinity.

What’s it good for?

Security

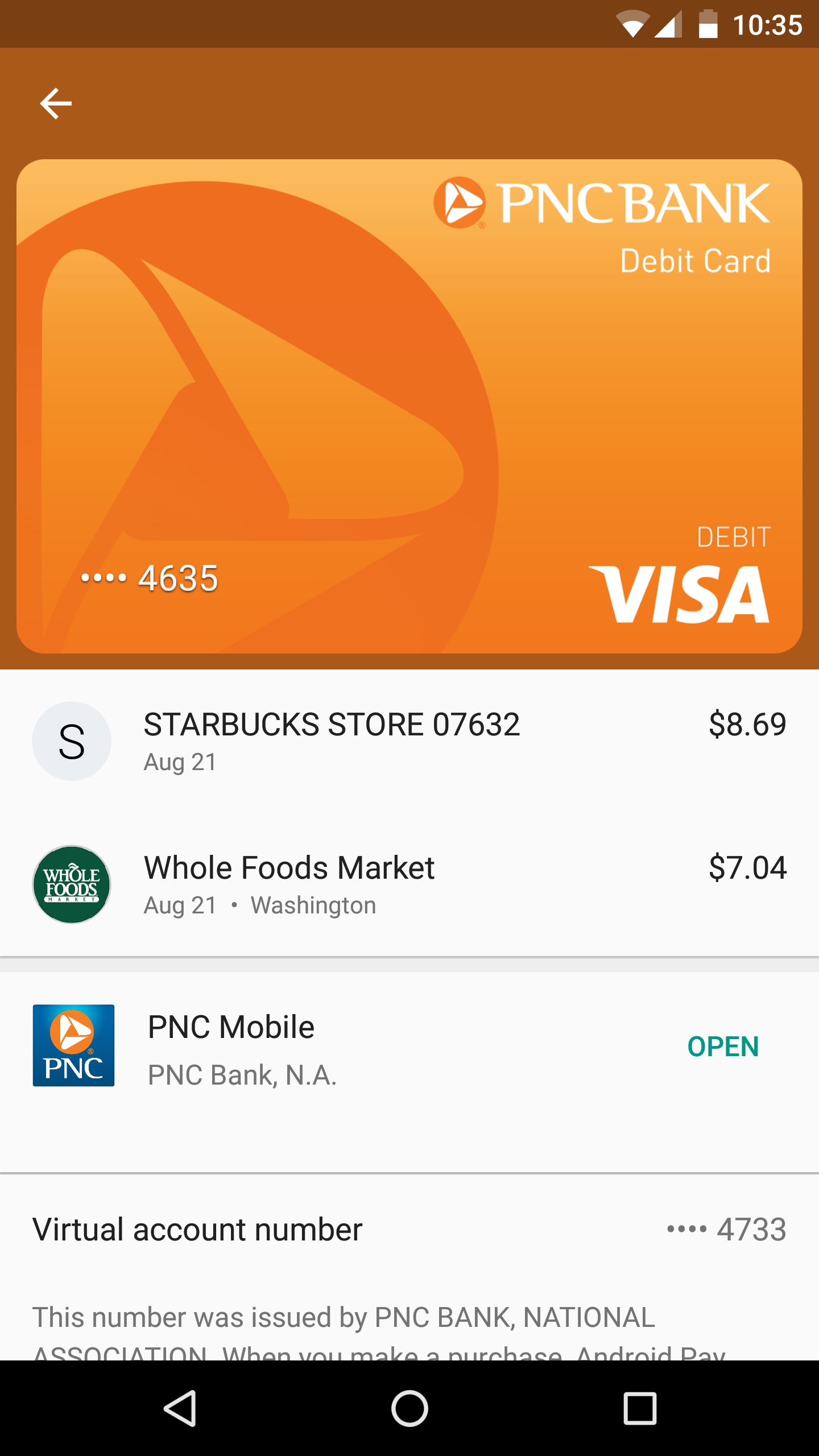

One of the clearest advantages of Android Pay and such techniques is the added security. Google does not share your actual card details with the vendor, but instead creates a virtual account and uses that to complete the transaction. Your device is locked with your fingerprint scan which is a lot safer than a 4 digit numeric PIN.

Convenience

This is not such a big one, but you no longer need to carry all your cards (debit/credit/loyalty/gift) with you everytime you step out of the house. Your phone holds all of them for you.

Analytics

It keeps track of all your purchases in one place. But in my opinion there are a lot many other apps which do the same thing and a lot better. See here for one such example.

In-app purchases

This one is more focussed towards app developers. Android Pay makes accepting money in your apps more seamless. Users do not need to add card details into every app. They can simply instruct the app to use Android Pay. Read more about it here.

What’s it not so good at?

I’ve had my card details entered into the app for quite a while now and tried to use Android Pay at various locations in Baltimore. To my surprise it almost never worked. Sometimes, it would decline the card altogether, and at other times, it would make me enter my debit card PIN into the machine, and then decline the transaction. For a good 6 months, I treated the feature as a beta and overlooked it.

@AndroidDev Any reason why Android Pay works in D.C. but not in Baltimore? #Android

— Sushant Athley (@SushantAthley) August 23, 2016

But then suddenly, on a recent trip to DC, it started to work for me. Paying for things was a breeze and every bit of suave as I thought it would be.

So in a nutshell, the service is flaky at the moment.

Secondly, on some occasions it makes you enter your PIN number which defeats the purpose of having a fingerprint scanner on the device.

Thirdly, you really can’t leave home without your cards. You don’t want to be that guy at the restaurant who demands the card-accepting terminal be brought before him so that his highness may tap his phone onto it.

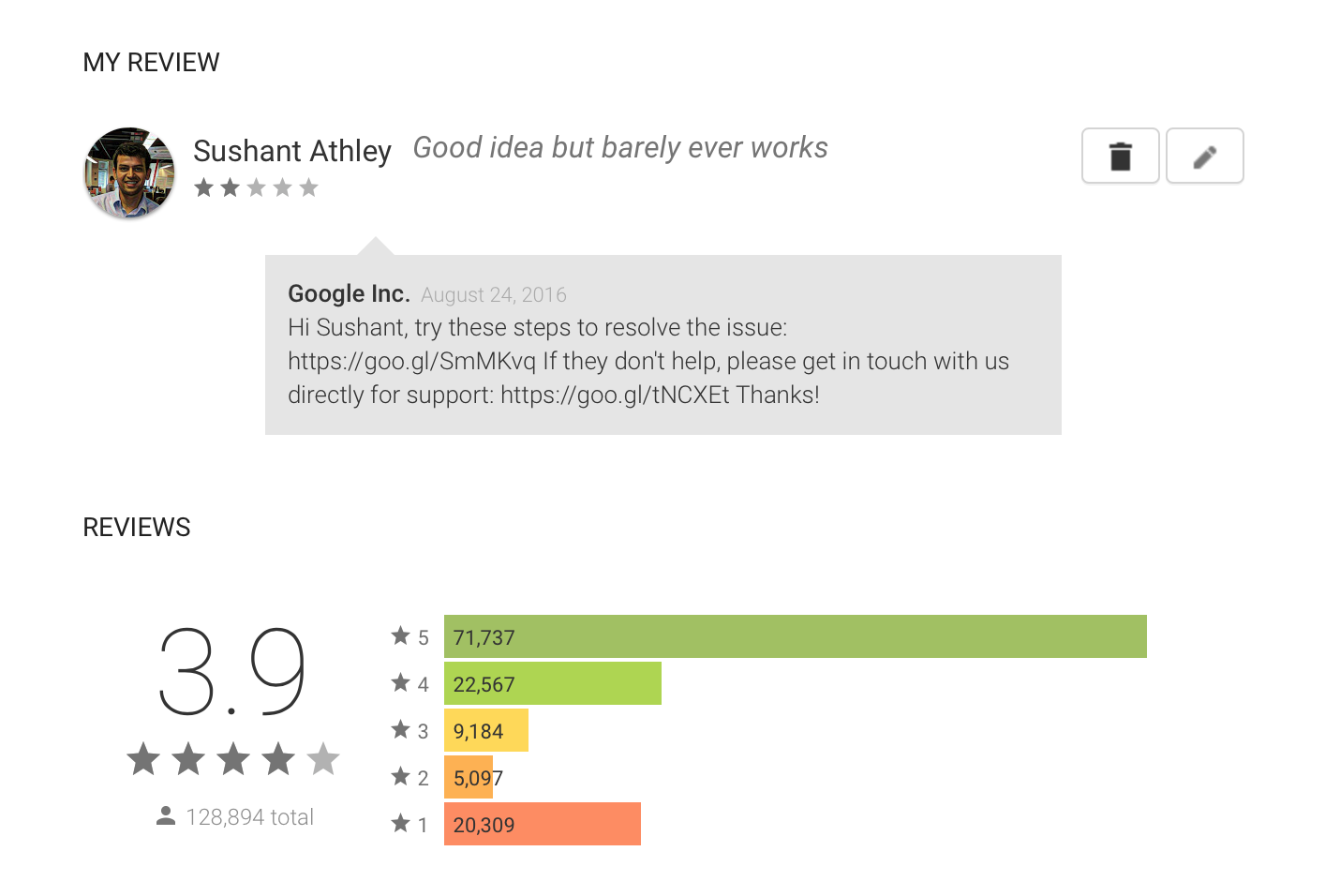

EDIT: I recently received a reply on my review of the Android Pay app on the Play Store. It was not very helpful. It basically says, “If your transaction is declined, contact your card-issuing bank for more information.” Now that, is not very helpful.